I’ve lost count of the late-night war rooms spent reconciling orders that vanished between CRM and billing, or invoices stuck because a PO field was missing. The pattern was always the same: growth slowed, cash got lumpy, and teams were firefighting exceptions buried in email. The turning point came when we rethought lead-to-cash as a stage-gated, event-driven pipeline with zero-touch as the default. This article distills what worked—how to design the workflow, integrate your systems, accelerate cash flow, and choose an iPaaS that scales.

Introduction: Unlocking Growth with Zero-Touch Lead-to-Cash Automation

Growth stalls when revenue flow is trapped between CRM, CPQ, billing, accounting, and onboarding. Zero-touch lead-to-cash removes those handoffs so quotes, orders, invoices, revenue schedules, collections, and provisioning move automatically—humans only handle flagged exceptions. The payoff: faster cash, lower cost to serve, tighter compliance, and a premium onboarding experience.

Growth levers

- Velocity: Auto-approve within policy, auto-generate orders/invoices, same-day provisioning; shrink quote-to-invoice from days to hours and reduce DSO with instant billing and intelligent collections.

- Accuracy/compliance: Single customer/order schema, automated revenue recognition, continuous audit trails.

- Capacity: Straight-through processing for the majority of deals; reallocate ops time from data entry to exception management.

- Experience: Clean handoffs eliminated; standardized onboarding cuts time-to-value and churn risk.

- Visibility: Real-time pipeline-to-cash KPIs, exception queues, and SLA tracking.

Common pitfalls

- Automating broken processes and edge cases first.

- Over-customized CPQ and pricing rules that block scale.

- Point-to-point “spaghetti” integrations without a canonical data model.

- Manual exceptions buried in email/Slack; no ownership or auditability.

- Ignoring permissions, entitlements, and SOC 2/GAAP controls.

- Underinvesting in monitoring, idempotency, and change management.

What “good” looks like

- Standard SKUs, price books, discount guardrails; policy-based approvals.

- Event-driven integrations (native or iPaaS) with a canonical customer/order/entitlement model; low-latency, idempotent sync.

- Auto-creation of orders, invoices, and payment intents on booking; dunning and collections workflows out-of-the-box.

- Automated ASC 606 revenue schedules and reconciliations.

- Line-item–driven provisioning and onboarding playbooks with SLA timers.

- Exception management with reason codes, auto-routing, and full audit logs.

- Security by design: RBAC, SSO, field-level permissions, segregation of duties.

- Operational KPIs: quote-to-cash cycle time, time-to-invoice, DSO, billing accuracy/dispute rate, onboarding TTV, automation coverage (% no-touch), exception rate, and cost per order—reviewed weekly with clear owners.

Designing an End-to-End Lead-to-Cash Workflow: Key Components and Frameworks

Design the lead-to-cash system as a stage-gated, zero-touch pipeline with explicit ownership, SLAs, and data contracts, orchestrated across CRM, CPQ, billing/accounting, and onboarding.

Core stages, ownership, SLAs, data contracts

- Lead → MQL (Marketing): SLA—SDR touch within 15 minutes. Data contract—Lead, Account, Contact (source, UTM, ICP fit score).

- MQL → SQL (Sales Dev): SLA—qualification within 4 hours. Data contract—Account becomes SSOT in CRM; dedupe rules, legal name, billing country.

- Opportunity/CPQ (Sales/RevOps): SLA—quote in 24 hours; approvals within 4 hours. Data contract—Quote, Products, Price Book, Term, Start Date, Tax nexus, Payment terms.

- Contract & eSign (Sales/Legal): SLA—send for signature within 24 hours of verbal commit. Data contract—Order/Subscription, MSA/Order Form version, countersigned PDF ID.

- Order Provisioning (RevOps/IT/Engineering): SLA—auto-provision within 15 minutes of signature/payment. Data contract—Entitlements, Seats, Plan, Environment/Org ID.

- Billing & Invoicing (Finance): SLA—invoice within 24 hours; tax calculation at invoice. Data contract—Invoice, Tax details, Payment method token, PO number.

- Payment & Collections (Finance): SLA—auto-charge on due date; dunning cadence T+3/7/14. Data contract—Payment, Refund, Chargeback, Remittance advice.

- Revenue Recognition (Finance): SLA—ASC 606 schedules generated on invoice; close by Day 3. Data contract—Rev Rec schedule, Deferred revenue GL.

- Onboarding & Activation (CS/PS): SLA—kickoff in 1 business day; time-to-first-value within 14 days. Data contract—Project, Milestones, Health score.

- Renewal & Expansion (Sales/CS): SLA—90/60/30-day outreach. Data contract—Renewal quote, Co-term rules, Price uplift.

Design frameworks

- RACI + SLA matrix per stage; publish in your RevOps playbook.

- Data contract registry: authoritative system per object, required fields, validation rules, ID strategy, versioning.

- Automation architecture: prefer event-driven orchestration (webhooks + message bus) with an iPaaS (Workato/Tray) governing retries, idempotency keys, and DLQs; use native connectors for CRM/CPQ/Billing; avoid custom point-to-point code.

- Change governance: CAB, sandbox-first, versioned workflows, release windows, audit logs (SOC 2/SOX).

- Exception handling: taxonomy (pricing, tax, credit, provisioning), auto-route to queues with SLA timers; Slack/Email approvals recorded in system of record.

KPIs to manage

- Quote-to-cash cycle time

- DSO

- Invoice accuracy >99.5%

- Automation rate >85% of orders

- Provisioning time <15 minutes

- Time-to-first-value

- Dispute rate <1%

- Exception rate per 100 orders

- Manual touches per order

Integrating CRM, CPQ, Billing, and Onboarding Systems for Seamless Data Sync

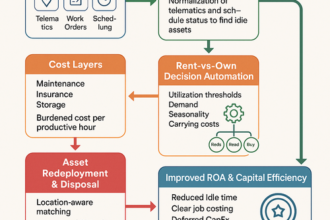

Integrate around a canonical data model and event-driven spine to keep CRM, CPQ, billing/ERP, and onboarding synchronized without human handoffs.

Architecture blueprint

- System of record per domain:

- Accounts/Contacts: CRM for sales context; Billing Account/Legal Entity: billing/ERP.

- Product Catalog and Price Books: CPQ (with effective-dated versions).

- Orders/Subscriptions/Invoices/Payments: billing/ERP.

- Entitlements/Provisioning: onboarding/provisioning platform.

- Canonical IDs and external IDs: generate a stable customer_id, product_id, and subscription_id; store as external IDs in every system to prevent duplicates and enable idempotent upserts.

- Event model: use webhooks/outbox pattern to emit events (e.g., Quote.Agreed, Order.Created, Invoice.Paid, Usage.Posted, Provisioned). Deliver via iPaaS or an event bus (e.g., EventBridge/Kafka) with retries and ordering.

Zero-touch flow

- CRM: Opportunity → Quote approved → emit Quote.Agreed with product lines, terms, price book version, co-terming.

- CPQ: Locks product/price references; pushes Order intent.

- Billing/ERP: Creates Customer, Subscription/Order, tax (Avalara/TaxJar), revenue schedules; issues invoice or schedule; returns IDs/payment link.

- Payments: Status events (Succeeded/Failed) update billing and CRM; trigger dunning as needed.

- Onboarding: Autocreates project in PSA/CS tool with entitlements, milestones, SLAs; provisioning via APIs to product.

- Amend/Renew: Effective-dated amendments co-termed; cascade to rev rec.

Reference data strategy

- Product master: SKUs, units, bundles, GL/revenue rules, tax codes; versioned price books with start/end dates.

- Customer hierarchy: parent/child, sold-to/bill-to/ship-to.

- Multi-currency and FX rates; country tax nexus.

- Approval matrices and credit limits as policy objects.

Error handling and observability

- Idempotency keys, exponential backoff, dead-letter queues, and compensating actions.

- Reconciliation jobs: daily compare counts/hashes across systems; auto-heal drifts.

- Exception queue with SLAs and audit trail (e.g., Jira/ServiceNow), not email/Slack.

Tooling guidance

- Mid-market: Workato/Tray/Make + Stripe Billing/Chargebee + Salesforce/HubSpot + NetSuite/QuickBooks + Gainsight/Asana.

- Enterprise: MuleSoft/Boomi + Zuora/SAP/Oracle + Salesforce + NetSuite/SAP + Jira/ServiceNow.

- Security: least-privilege API keys, secrets vault, field-level permissions, full audit logs (SOC 2/GAAP).

KPIs

- Touchless order rate ≥90%

- Sync latency ≤5 minutes

- Data match rate ≥99.5%

- Quote-to-invoice cycle time ↓50%

- DSO ↓5–10 days

- Exception resolution SLA ≤2 hours

Accelerating Cash Flow: Reducing DSO and Automating Invoicing, Collections & Exceptions

Objective: Cut DSO by 10–30% and increase straight‑through cash application to 85%+ by implementing a zero‑touch invoicing, collections, and exceptions engine across CRM→CPQ→Billing→Accounting.

Design the policies

- Terms by segment: SMB (autopay, Net 0–15); Mid‑market (Net 30, ACH/SEPA mandate); Enterprise (Net 30–45 with PO). Enforce tax IDs/POs pre‑close.

- Incentives/controls: 1–2% early‑pay discount, late fees, payment plans for at‑risk accounts, credit checks at quote.

- Billing calendar: weekly cutoffs; pro‑forma approval rules; reason codes for disputes; write‑off thresholds.

Automate the flow (zero‑touch)

- Data contract: Mandatory fields in CRM/CPQ (bill‑to/ship‑to, tax nexus, payment method, PO, start date). Validate with RevOps guardrails.

- Invoice triggers: Auto‑generate on activation/milestone; attach PO; compute tax (Avalara/Sovos); e‑invoice (Peppol) where required.

- Payments: Collect upfront for prepay; store mandate (ACH/SEPA) and card token; smart retries, account updater, network tokens; customer portal for self‑service.

- Collections orchestration: Segmented dunning (timing/channel/tone by risk/ARR); omnichannel (email/SMS/in‑app); promise‑to‑pay capture; auto‑offer payment plans.

- Cash application: Bank feeds/lockbox, remittance OCR, AI matching rules, auto‑post with confidence thresholds; reconcile daily to GL.

- Dispute workflow: Auto‑route to queue with reason code, owner, SLA, and escalation; link to tickets/CS; auto‑credit memo generation when approved.

- Exception queues: Only surface low‑confidence matches, high‑risk delinquencies, tax/PO mismatches; aging and auto‑escalations to finance/AE.

KPIs to monitor (weekly)

- DSO, Average Days Delinquent, CEI

- % invoices sent <24h of milestone

- % autopay, % e‑invoicing

- STP cash‑app %

- Dispute rate and median resolution time

- Write‑off %

- Promise‑to‑pay kept

- Collector touches per $ collected

Tooling blueprint

- CRM/CPQ: Salesforce + Salesforce CPQ/DealHub.

- Billing/Revenue: Chargebee/Zuora/Stripe Billing + RevRec or NetSuite/Sage Intacct.

- AR automation: Tesorio/HighRadius/Versapay/YayPay; Payments: Stripe/Adyen; Tax: Avalara.

- Integration: Event‑driven iPaaS (Workato/Tray/Dell Boomi/MuleSoft) with audit trails, least‑privilege access, SOC 2/PCI scope defined.

Cadence

Stand‑up on AR exceptions, root‑cause analytics on dispute codes, and quarterly policy tuning to keep DSO trending down.

Selecting Scalable iPaaS Solutions: Tools, KPIs, and Best Practices for ROI-Driven Automation

Your iPaaS becomes the control plane for zero‑touch operations. Choose a platform that balances speed, governance, and cost transparency.

What to prioritize in a scalable iPaaS for zero‑touch lead‑to‑cash

- Connectors and data model: Native, well-maintained connectors for Salesforce/HubSpot, CPQ (Salesforce CPQ), billing (Stripe, Chargebee, Zuora), accounting (NetSuite, QuickBooks, Xero), provisioning/onboarding (Jira, Zendesk, Gainsight), identity (Okta). Support for webhooks, bulk APIs, rate-limit handling, upserts, and idempotency to prevent duplicate orders/invoices.

- Orchestration: Event-driven and long-running workflows, conditional logic, approvals, human-in-the-loop, data transformation/mapping, versioning, and rollback. SLAs per flow (e.g., quote-to-invoice <15 min).

- Monitoring and observability: End-to-end traceability, message replay/dead-letter queues, proactive alerts, business-level dashboards (invoice latency, exception rate), data lineage, and audit logs.

- Security and compliance: SOC 2 Type II, ISO 27001, GDPR controls, SSO/SAML, granular RBAC, secrets vault, field-level encryption/PII masking, environment isolation (dev/test/prod), change approval trails to support GAAP/SOX audits.

- Governance and scale: Reusable components, templates, CI/CD, Infrastructure-as-Code or APIs for provisioning, throughput/concurrency SLAs, multi-region, hybrid/on-prem agents, SDKs for custom connectors. Clear pricing transparency to forecast volume-based costs.

Tool fit snapshot

- Mid-market speed: Workato, Tray.io, Celigo (strong NetSuite). Best for recipe-based scale, robust governance.

- Enterprise control: Boomi, MuleSoft (deep governance, hybrid), higher setup cost.

- Lightweight/departmental: Make, Zapier (fast prototyping, limited governance).

- Open-source/self-host: n8n (control, higher ops overhead).

KPIs to prove ROI and control TCO

- Quote-to-cash cycle time; DSO; time-to-invoice; onboarding time-to-value.

- Manual touches per order; first-pass yield/error rate; exception rate and MTTR.

- Integration run cost per transaction; automation coverage %; deployment frequency.

Best practices

- Baseline current metrics and target payback (<6 months). Prioritize 3 flows: quote→order, order→invoice, invoice→collection.

- Implement MDM/ownership for accounts, products, SKUs; standardize IDs.

- Design for idempotency, retries, and compensation steps; document SLAs.

- Establish an Automation CoE: guardrails for citizen builders, code reviews, templates.

- Start with a 90-day pilot, measure KPI deltas, then scale via reusable patterns.

- Negotiate exit clauses, connector SLAs, and data export to reduce vendor lock-in.